What’s next for marketplace startups? Reinventing the $10 trillion service economy, that’s what.

[Dear readers, this essay is on the future of marketplaces. Is there still room for marketplace startups to innovate? We answer, emphatically, yes! Am excited to share a vision on the past and future of the service economy, in a collaboration by my a16z colleague Li Jin. From “Unbundling Craiglist” to “Uber for X” – we lay it all out in a single framework. Hope you enjoy our thinking! -A]

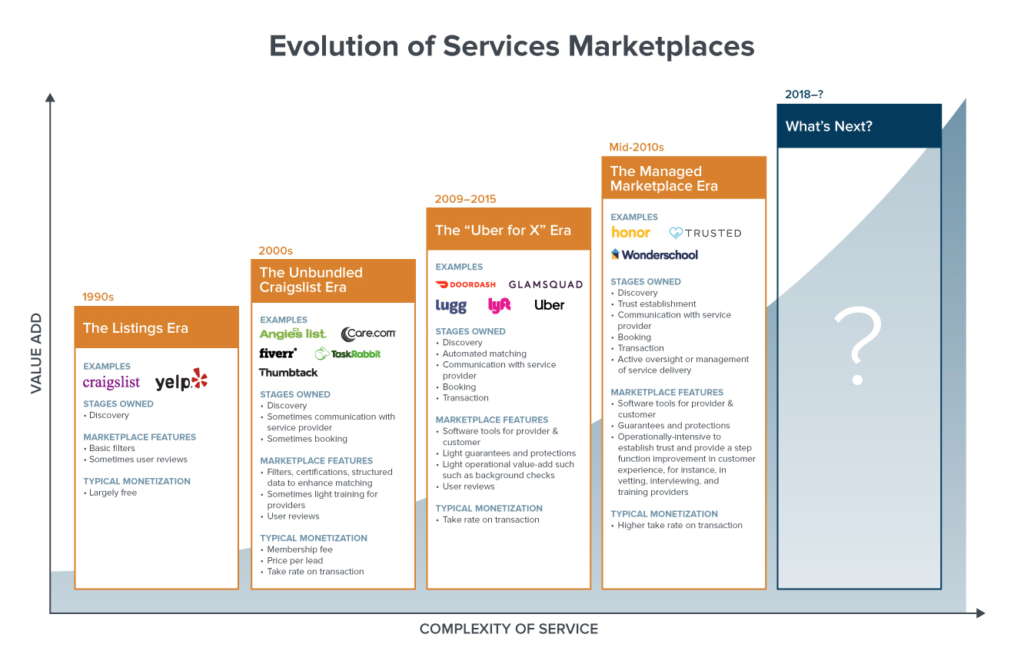

Above: 4 eras of marketplaces focused on the service economy – and what’s next

Goods versus Services – why a breakthrough is coming

Marketplace startups have done incredibly well over the first few decades of the internet, reinventing the way we shop for goods, but have been less successful services. In this essay, we argue that a breakthrough is on its way: While the first phase of the internet has been about creating marketplaces for goods, the next phase will be about reinventing the service economy. Startups will build on the lessons and tactics to crack the toughest service industries – including regulated markets that have withstood digital transformation for decades. In doing this, the lives of 125 million Americans who work in the services-providing industries will join the digital transformation of the economy.

In the past twenty years, we’ve transformed the way people buy goods online, and in the process created Amazon, eBay, JD.com, Alibaba, and other e-commerce giants, accounting for trillions of dollars in market capitalization. The next era will do the same to the $9.7 trillion US consumer service economy, through discontinuous innovations in AI and automation, new marketplace paradigms, and overcoming regulatory capture.

The service economy lags behind: while services make up 69% of national consumer spending, the Bureau of Economic Analysis estimated that just 7% of services were primarily digital, meaning they utilized internet to conduct transactions.

We propose that a new age of service marketplaces will emerge, driven by unlocking more complex services, including services that are regulated. In this essay, we’ll talk about:

- Why services are still primarily offline

- The history of service marketplace paradigms

- The Listings Era

- The Unbundled Craigslist Era

- The “Uber for X” Era

- The Managed Marketplace Era

- The future of service marketplaces

- Regulated services

- Five strategies for unlocking supply in regulated markets

- Future opportunities

Let’s start by looking at where the service economy is right now and why it’s resisted a full scale transformation by software.

Software eating the service economy, but it’s been slow

We’ve all had the experience of asking friends for recommendations for a great service provider, whether it be a great childcare provider, doctor, or hair stylist. Why is that? Why aren’t we discovering and consuming these services in the same digital way we’ve come to expect for goods?

Despite the rise of services in the overall economy, there are a few reasons why services have lagged behind goods in terms of coming online:

- Services are complex and diverse, making it challenging to capture relevant information in an online marketplace

- Success and quality in services is subjective

- Fragmentation – small service providers lack the tools or time to come online

- Real-world interaction is at the heart of services delivery, which makes it hard to disaggregate parts of a purchase that might be done online

Let’s unpack each reason below:

First, on the complexity and diversity of services, services are performed by providers who vary widely, unlike goods which are manufactured to a certain spec. Even the names of services can vary: what one home cleaning service calls a “deep clean” can be different from another provider’s definition. This lack of standardization makes it difficult for a service marketplace to capture and organize the relevant information.

Second, services are often complex interactions without a clear yardstick of success or quality. The customer experience of a service is often subjective, making traditional marketplace features like reviews, recommendations, and personalization more difficult to implement. Sometimes just getting the job completed (as in rideshare) is sufficient to earn a 5-star review, whereas other higher-stakes services, like childcare, have complex customer value functions, including safety, friendliness, communicativeness, rapport with child, and other subjective measures of success.

Third, small service providers often lack the tools or time to come online. In many service industries, providers are small business owners with low margins; contrast this with goods manufacturing where there are economies of scale in production, and thus consolidation into large consumer products companies. As a result of industry fragmentation, service providers often don’t have time or budget to devote to key business functions, such as responding to customer requests, promoting and marketing themselves, maintaining a website, and other core functions. While major e-commerce platforms have taken on the role of distribution, merchandising, and fulfilling orders for goods, there are few platforms that service providers can plug into to manage their businesses and reach customers.

Fourth, real-world interaction is central to services, which can pull other steps of the services funnel into the offline world as well. Many services are produced and consumed simultaneously in real-world interactions, whereas goods entail independent stages of production, distribution, and consumption. The various stages of the goods value chain can be easily unbundled, with e-commerce marketplaces comprising the discovery, transaction, and fulfillment steps. Conversely, since the production and consumption of services usually occur simultaneously offline, the discovery, distribution, and transaction pieces are also often integrated into the offline experience. For instance, since getting a haircut entails going to a salon and having interactions with the providers there, the stages of the value chain that precede and follow that interaction (discovery, booking, and payment) also often get incorporated into the in-person experience.

All of these factors make it very hard for services to come online as comprehensively and widely as commerce – but there’s hope. We’ve seen multiple eras of bringing the service economy online, and we’re on the verge of a breakthrough!

The 4 eras of Service Marketplaces, and what’s next

There have been 4 major generations of service marketplaces, but coverage of services and providers remains spotty, and many don’t provide end-to-end, seamless consumer experiences. Let’s zoom out and talk through each historical marketplace paradigm, and what we’ve learned so far.

Above, you can see that there have roughly been four major eras of marketplace innovation when it comes to the service economy.

1. The Listings Era (1990s)

The first iteration of bringing services online involved unmanaged horizontal marketplaces, essentially listing platforms that helped demand search for supply and vice versa. These marketplaces were the digital version of the Yellow Pages, enabling visibility into which service providers existed, but placing the onus on the user to assess providers, contact them, arrange times to meet, and transact. The dynamic here is “caveat emptor”–users assume the responsibility of vetting their counterparties and establishing trust, and there’s little in the way of platform standards, protections, or guarantees.

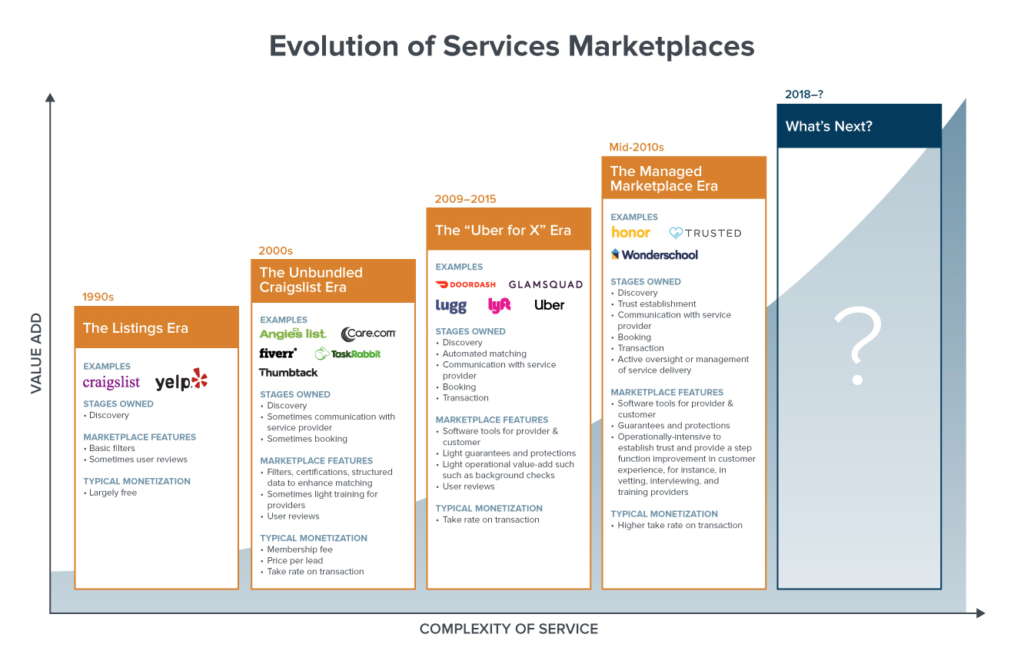

Craigslist’s Services category is the archetypal unmanaged service marketplace. It includes a jumble of house remodeling, painting, carpet cleaners, wedding photographers, and other services. But limited tech functionality means that it feels disorganized and hard to navigate, and there’s no way to transact or contact the provider without moving off the platform.

We’ve all had the experience of a listings-oriented product, like Craigslist. You find something you want, but everything else – trust/reviews/payments/etc – that’s all up to you!

2. The Unbundled Craigslist Era (2000s)

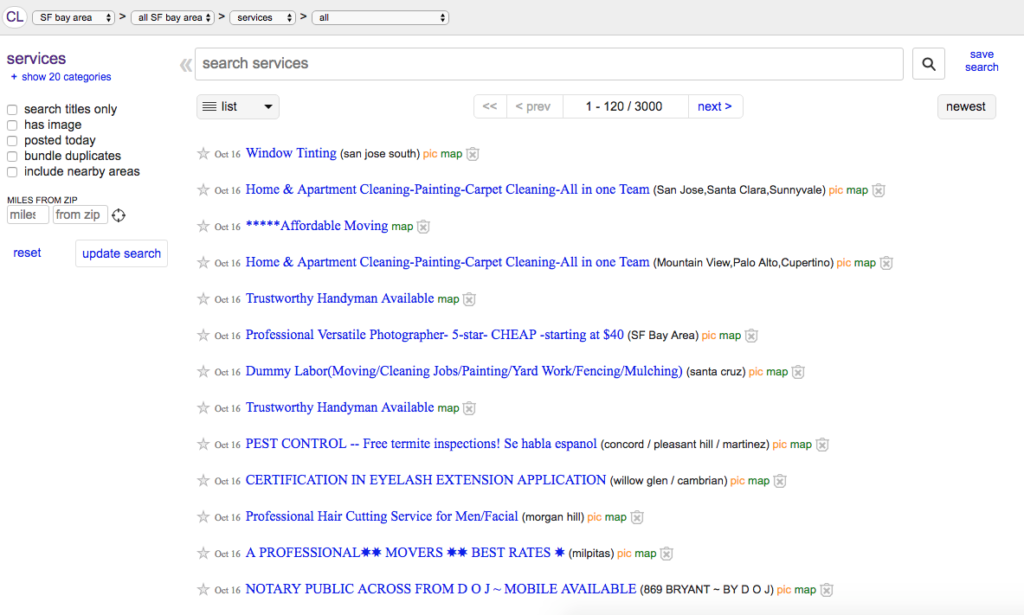

Companies iterated on the horizontal marketplace model by focusing on a specific sub-vertical, enabling them to offer features tailored to a specific industry. We’ve all seen the diagram of various companies picking off Craigslist verticals – it looks something like this:

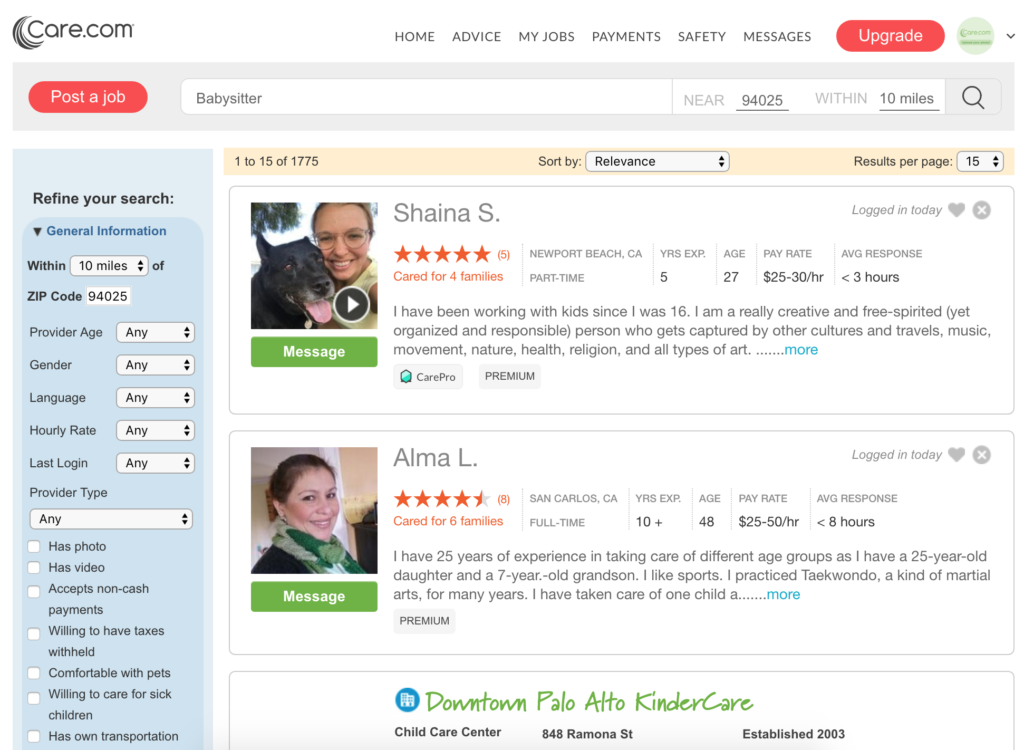

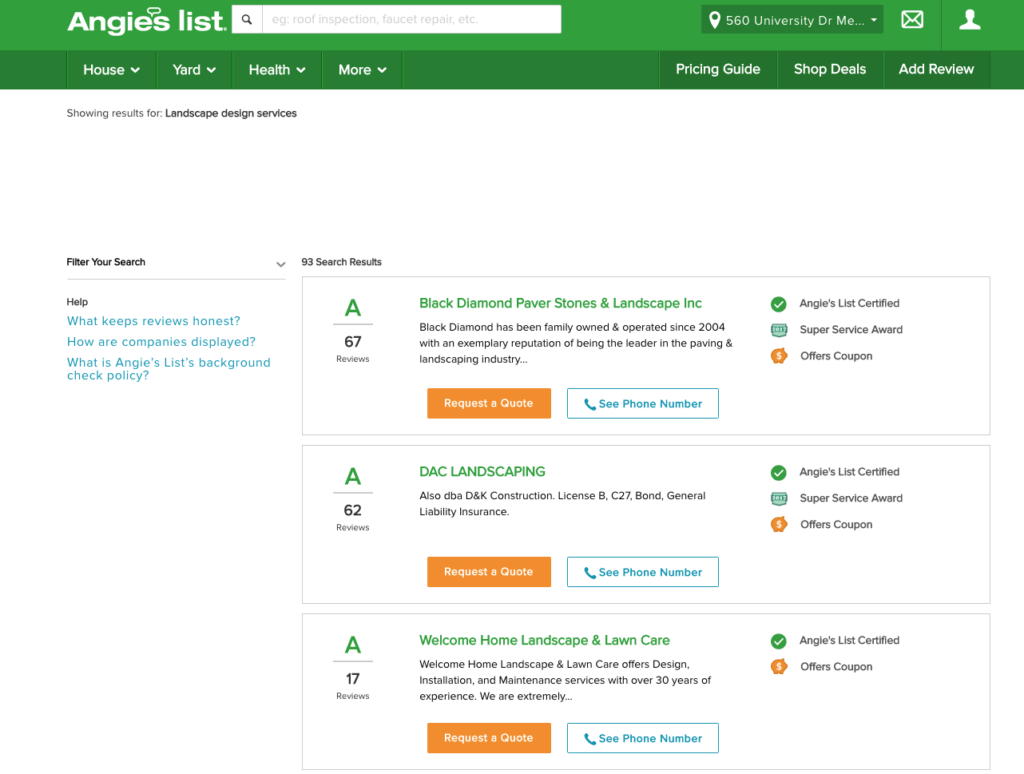

As a reaction to the “Wild West” nature of Craigslist, to improve the customer experience, each startup would create value-add via software. For instance, Care.com carves off the Childcare section of Craigslist, and provides tech value-add in the form of filters, structured information, and other features to improve the customer experience of finding a local caregiver. It’s a huge leap in terms of user experience over Craigslist’s Childcare section.

Angie’s List, a home services site founded in 2005, carves off Craigslist’s household services category. The platform has features including reviews, profiles, certified providers, and an online quote submission process. But the marketplace doesn’t encompass the entire end-to-end experience: users turn to Angie’s List for discovery, but still need to message or call providers and coordinate offline.

Unmanaged vertical marketplaces like Angie’s List go a step beyond Craigslist and take on some value-add services like certifying providers when they meet certain standards, but customers still need to select and contact the service provider, place their trust in the provider rather than the platform, and transact offline.

Like previous listing sites, these platforms in this era try to use the ‘wisdom of the crowds’ to promote trust. These platforms have a network effect in that more reviews means more users and more reviews. But user reviews have their limitations, as every user has a unique value function that they’re judging a service against. Without standardized moderation or curation, and without machine learning to automate this process, customers have the onus of sifting through countless reviews and selecting among thousands of providers.

3. The “Uber for X” Era (2009-)

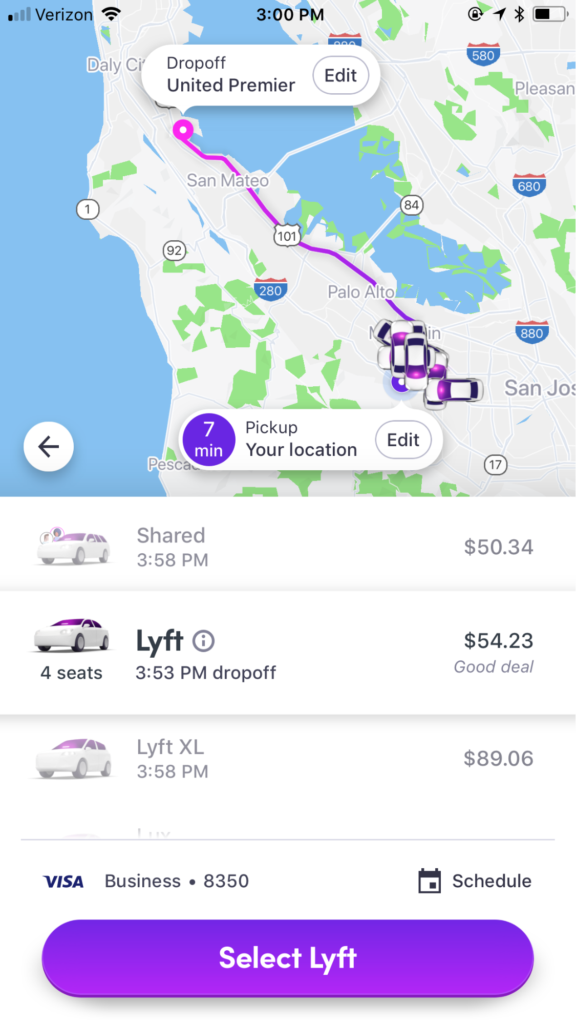

In the early 2010s, a wave of on-demand marketplaces for simple services arose, including transportation, food delivery, and valet parking. These marketplaces were enabled by widespread mobile adoption, making it possible to book a service or accept a job with the tap of a button.

Companies like Handy, Lugg, Lyft, Rinse, Uber and many others made it efficient to connect to service providers in real-time. They created a full-stack experience around a particular service, optimizing for liquidity in one category. For these transactions, quality and success were more or less binary–either the service was fulfilled or it wasn’t–making them conducive to an on-demand model.

These platforms took on various functions to establish an end-to-end, seamless user experience: automatically matching supply and demand, setting prices, handling transactions, and establishing trust through guarantees and protections. They also often commoditized the underlying service provider (for instance, widespread variance on the driver side of rideshare marketplaces is distilled into Uber X, Uber Pool, Uber Black, Uber XL, etc.).

Unlike the previous generations of marketplaces, in which the provider ultimately owns the end customer relationship, these on-demand marketplaces became thought of as the service provider, e.g. “I ordered food from DoorDash” or “Let’s Uber there,” rather than the underlying person or business that actually rendered the service.

Over time, many startups in this category failed, and the ones that survived did so by focusing on and nailing a frequent use case, offering compelling value propositions to demand and supply (potentially removing the on-demand component, which wasn’t valuable for some services), and putting in place incentives and structures to promote liquidity, trust, safety, and reliability.

4. The Managed Marketplace Era (Mid-2010s)

In the last few years, we’ve seen a rise in the number of full-stack or managed marketplaces, or marketplaces that take on additional operational value-add in terms of intermediating the service delivery. While “Uber for X” models were well-suited to simple services, managed marketplaces evolved to better tackle services that were more complex, higher priced, and that required greater trust.

Managed marketplaces take on additional work of actually influencing or managing the service experience, and in doing so, create a step-function improvement in the customer experience. Rather than just enabling customers to discover and build trust with the end provider, these marketplaces take on the work of actually creating trust.

In the a16z portfolio, Honor is building a managed marketplace for in-home care, and interviews and screens every care professional before they are onboarded and provides new customers with a Care Advisor to design a personalized care plan. Opendoor is a managed marketplace that creates a radically different experience for buying and selling a home. When a customer wants to sell their home, Opendoor actually buys the home, performs maintenance, markets the home, and finds the next buyer. Contrast this with the traditional experience of selling a home, where there is the hassle of repairs, listing, showings, and potentially months of uncertainty.

Managed marketplaces like Honor and Opendoor take on steps of the value chain that platforms traditionally left to customers or providers, such as vetting supply. Customers place their trust in the platform, rather than the counterparty of the transaction. To compensate for heavier operational costs, it’s common for managed marketplaces to actually dictate pricing for services and charge a higher take rate than less-managed marketplace models.

Managed marketplaces are a tactic to solve a broader problem around accessing high-quality supply, especially for services that require greater trust and/or entail high transaction value. If we zoom out further, there’s many more categories of services that can benefit from managed models and other tactics to unlock supply.

What’s next: The future of Service Marketplaces (2018-?)

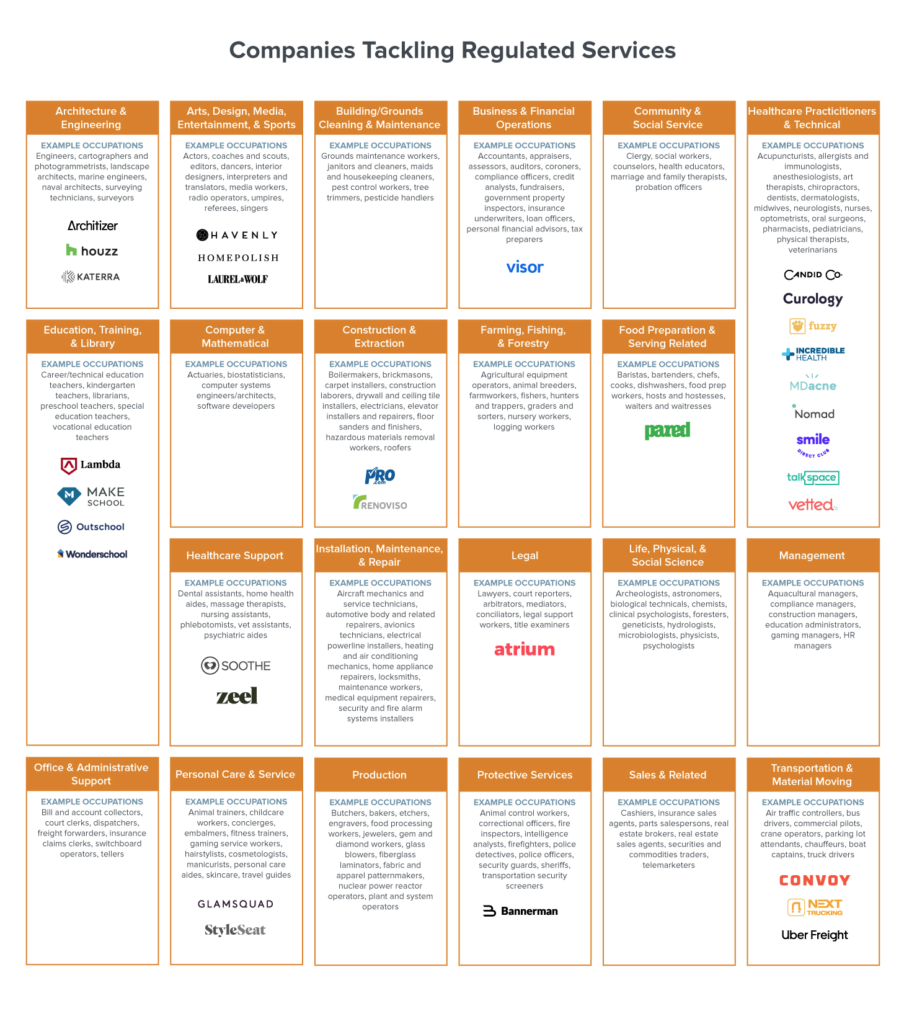

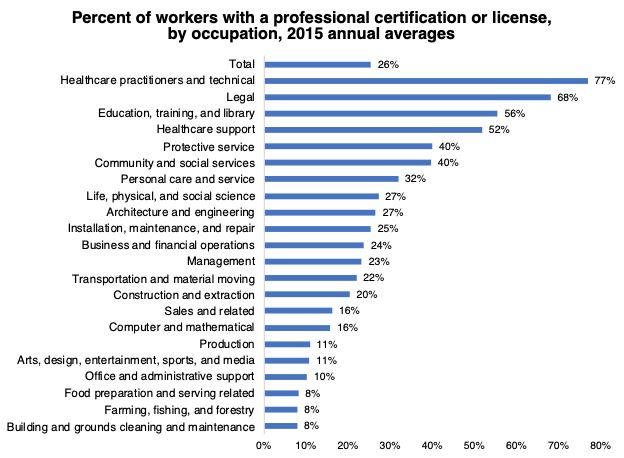

We think the next era of service marketplaces have potential to unlock a huge swath of the 125 million service jobs in the US. These marketplaces will tackle the opportunities that have eluded previous eras of service marketplaces, and will bring the most difficult services categories online–in particular, services that are regulated. Regulated services–in which suppliers are licensed by a government agency or certified by a professional or industry organization–include engineering, accounting, teaching, law, and other professions that impact many people’s lives directly to a large degree. In 2015, 26% of employed people had a certification or license.

Regulation of services was critical pre-internet, since it served to signify a certain level of skill or knowledge required to perform a job. But digital platforms mitigate the need for licensing by exposing relevant information about providers and by establishing trust through reviews, managed models, guarantees, platform requirements, and other mechanisms. For instance, most of us were taught since childhood never to get into cars with strangers; with Lyft and Uber, consumers are comfortable doing exactly that, millions of times per day, as a direct result of the trust those platforms have built.

Licensing of service professions create an important standard, but also severely constrains supply. The time and money associated with getting licensed or certified can lock out otherwise qualified suppliers (for instance, some states require a license to braid hair or to be a florist), and often translates into higher fees, long waitlists, and difficulty accessing the service. The criteria involved in getting licensed also do not always map to what consumers actually value, and can hinder the discovery and access of otherwise suitable supply.

Above: Bureau of Labor Statistics. (11/9/18)

Five strategies to unlock regulated industries

We’re starting to see a number of startups tackling regulated services industries. As with each wave of previous service marketplaces, these new approaches bring more value-add to unlock the market, with variations in models that are well-suited to different categories.

The major approaches in unlocking supply in these regulated industries include:

- Making discovery of licensed providers easier

- Hiring and managing existing providers to maintain quality

- Expanding or augmenting the licensed supply pool

- Utilizing unlicensed supply

- Automation and AI

1) Making discovery of licensed providers easier

Some startups are tackling verticals that lack good discovery of licensed providers. Examples include Houzz, which enables users to search for and contact licensed home improvement professionals, and StyleSeat, which helps users find and book beauty appointments with licensed cosmetologists.

2) Hiring and managing existing providers to maintain quality

Companies can raise the quality of service by hiring and managing providers themselves, and by managing the end-to-end customer experience. Examples are Honor and Trusted, managed marketplaces for elder care and childcare, respectively, which employ caregivers as W-2 employees and provide them with training and tools. In the real estate world, Redfin agents are employees whose compensation is tied to customer satisfaction, unlike most real estate agents who are independent contractors working on commission.

3) Expanding or augmenting the licensed supply pool

Expanding the licensed supply pool can take the form of leveraging geographic arbitrage to access supply that’s not located near demand. Decorist, Havenly, Laurel & Wolf, and other online interior design companies enable interior designers around the world to provide design services to consumers without physically visiting their homes (yes, in many parts of the US interior design requires a license!). With improvements in real-time video, richer telepresence technologies, and better visualization technologies, more synchronous services are also shifting from being delivered in-person to online. Outschool and Lambda School are examples of de-localizing instruction, enabling teachers and students to participate remotely while preserving real-time interaction.

Another approach is to help suppliers navigate the certification process. A16z portfolio company Wonderschool makes it easier for individuals to get licensed and operate in-home daycares.

Lastly, there’s the approach of augmenting certified providers so they can serve more customers. Fuzzy, an in-home veterinary service, uses AI and vet technicians to augment the productivity of licensed veterinarians; and a16z portfolio company Atrium builds automation and workflow management to provide efficiency gains in the legal industry.

4) Utilizing unlicensed supply

Some companies utilize unlicensed supply–notably Lyft, Uber, and other peer-to-peer rideshare networks. Another example is Basis, a managed marketplace for guided conversations with trained but unlicensed specialists to help people with anxiety, depression and other mild to moderate mental health issues.

In the pet space, Good Dog is a marketplace that brings together responsible pet breeders and consumers looking for a dog. Going beyond existing breeder licensing, which the company felt didn’t map to what consumers valued, Good Dog established its own higher set of standards and screening process in conjunction with veterinary and academic experts.

5) Automation and AI

Other startups automate away the need for a licensed service provider altogether. These include MDAcne, which uses computer vision to diagnose and treat acne; and Ike Robotics and other autonomous trucking startups which remove the need for a licensed truck driver.

Opportunities for companies addressing regulated services

The last twenty years saw the explosion of a number of services coming online, from transportation to food delivery to home services, as well as an evolution of marketplace models from listings to full-stack, managed marketplaces. The next twenty years will be about the harder opportunities that software hasn’t yet infiltrated–those filled with technological, operational, and regulatory hurdles–where there is room to have massive impact on the quality and convenience of consumers’ everyday lives.

The services sector represents two-thirds of US consumer spending and employs 80% of the workforce. The companies that reinvent various service categories can improve both consumers’ and professionals’ lives–by creating more jobs and income, providing more flexible work arrangements, and improving consumer access and lowering cost.

The companies mentioned in this essay just scratch the surface of regulated industries. You can imagine a marketplace for every service that is regulated, with unique features and attributes designed to optimize for the customer and provider needs for that industry. (A full list of regulated professions in the US can be found here.) We fully expect more Airbnb- and rideshare-sized outcomes in the service economy.

If you’re a founder who is looking to take on the challenge of tackling more complex services and bringing them online, we’d love to hear from you.

Thank you for reading!

PS. Get new updates/analysis on tech and startupsI write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.